Intelligent Automation Solutions for Financial Services: Elevate Efficiency, Productivity, and Compliance

Empower your financial services with intelligent automation. Reach out to elevate productivity, efficiency, and compliance in one seamless solution!

Our Clients

Automation in finance and accounting services is transforming traditional operations, helping institutions improve efficiency, accuracy, and compliance across various functions. From loan origination to wealth management, customer service to compliance, and data management to corporate functions, automation streamlines processes, reduces manual workloads and enhances decision-making. Financial institutions can leverage automation to optimize operations, reduce errors, and provide better customer experiences while staying compliant with regulatory requirements.

Automation Use Cases in Financial Services

Loan Fulfillment

Automate the loan fulfilment process to improve accuracy and speed, reduce manual errors, and ensure timely service delivery.

Loan Origination

Streamline loan origination by automating data collection and verification, speeding up approvals while maintaining compliance.

Application Processing

Improve application processing by automating data entry and validation, reducing delays, and ensuring smoother customer experiences.

Mortgage

Automate mortgage workflows from application to approval, enhancing speed and compliance while reducing manual intervention.

Credit Card

Optimize credit card issuance by automating verification processes, ensuring faster approvals and reducing processing time.

Auto

Simplify auto loan processing by automating the underwriting and approval steps, resulting in faster loan disbursements.

Underwriting

Enhance underwriting efficiency with automated data analysis and risk assessment, reducing turnaround time and improving decision accuracy.

Fulfillment Status

Provide real-time updates on loan fulfillment status with automated tracking systems, keeping both customers and teams informed.

Collections

Automate collection processes with timely reminders and payment tracking, improving recovery rates and reducing manual effort.

Loan Servicing

Improve loan servicing with automation by effectively and accurately managing payments, statements, and customer interactions.

Data Acquisition

Automate data acquisition from multiple sources to ensure timely, accurate information for decision-making in financial services.

Fraud Detection

Leverage AI-powered automation to detect fraud in real-time, minimizing risks and protecting financial institutions from losses.

Wealth & Asset Management

Streamline operations with automation, improving portfolio management and client interactions. Enhance decision-making and reduce manual tasks for better overall performance.

Client Onboarding

Simplify and speed up the client onboarding process with automated workflows to ensure compliance and provide a seamless experience for new clients.

Portfolio Management

Automate portfolio management tasks to optimize asset allocation, minimize risks, and improve performance tracking, allowing for more strategic decision-making.

Performance Reporting

With automated data collection, you can generate real-time, accurate performance reports, offering clients a clear view of their investments with minimal effort.

Confirms Management

Automating the confirmation process, reducing manual errors, and ensuring timely updates will improve accuracy and efficiency in confirmation management.

Settlements

Streamline the settlement process with automation, ensuring faster transaction completion and reducing the risk of errors or delays.

Payments & Automated Account Transfers (ACAT)

Automate payments and account transfers, ensuring secure and timely processing while reducing the administrative burden on financial teams.

Customer Service

Automation in Customer service improves interactions by handling routine tasks. It enables service agents to concentrate on resolving more complex issues and boosts customer satisfaction.

Call Center Support

Leverage automation to streamline call center operations, reducing wait times and providing quicker responses to customer inquiries.

Credit Card Disputes

Automate the dispute resolution process for credit card transactions, ensuring timely and accurate handling of customer claims.

Account Opening & Closure

Automating the account opening and closure processes will simplify them, improve accuracy, reduce manual errors, and speed up approvals.

Address Verification

Automate the verification of customer addresses to ensure accurate data collection and reduce the risk of errors in customer records.

Customer Updates & Data Consolidation

Consolidate customer data efficiently with automated updates, ensuring records are always current and minimizing the risk of discrepancies.

Account Statements

Generate and deliver accurate account statements quickly and securely through automation, improving transparency and customer trust.

Complaint Processing

Automate complaint handling to ensure faster resolution, accurate tracking, and improved customer satisfaction through seamless case management.

Compliance

Adhere to financial regulations with automated systems that streamline compliance processes, reduce errors, and mitigate risks in real-time.

Know Your Customer (KYC) & Due Diligence

Automate KYC and due diligence procedures, speeding up client onboarding while maintaining accurate verification and reducing manual oversight.

Anti-Money Laundering (AML) & Financial Crimes Sanctions

Strengthen AML initiatives with intelligent automation, detect suspicious activities, and ensure adherence to financial crime regulations.

Flood Zone Tracking

Automatically track and update flood zone data, ensuring accurate risk assessments and regulatory compliance for property and insurance underwriting.

Regulatory Reporting

Streamline regulatory reporting by automating data collection, analysis, and submission, ensuring accuracy and timely compliance with evolving financial regulations.

Data Management

Streamline your data processes by organizing, storing, and maintaining information efficiently, ensuring accessibility and accuracy for informed decision-making.

Data Mining

Leverage data mining techniques to discover patterns and insights in large datasets, aiding in developing effective business strategies and revealing opportunities.

Data Validation

Implement thorough validation processes and identify errors and inconsistencies before they impact operations to ensure data accuracy and reliability.

Legacy System Data Migration

Seamlessly transfer data from outdated systems to modern platforms, maintaining data integrity while improving system performance and efficiency.

Compliance & Internal Audit Data Testing

Strengthen compliance and internal audit efforts with data testing solutions to ensure accuracy, detect anomalies, and support regulatory standards.

Corporate Functions

Automate routine tasks across corporate functions, freeing up time for strategic initiatives and improving overall efficiency in managing company-wide operations.

Finance

Streamline financial operations by automating key processes such as manual reconciliations, invoice processing, and cash reporting, ensuring accuracy and faster completion.

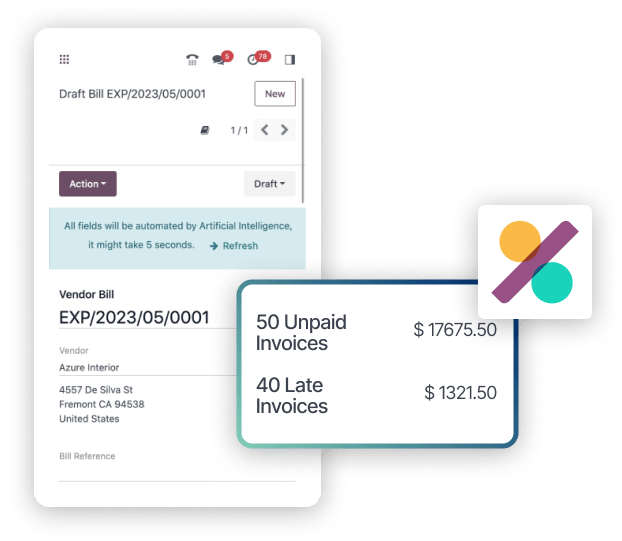

Manual Reconciliations

Automating data matching and verification can reduce the time spent on manual reconciliations, ensuring accurate financial records with minimal effort.

AP Invoice Processing

Automate accounts payable invoice processing to improve payment accuracy, reduce errors, and accelerate payment cycles for better cash flow management.

Cash Reporting

Automating data collection and report generation enhances cash reporting processes, providing real-time insights into cash flow and financial health.

Human Resources

Automate Human Resource processes like employee onboarding, recruiting, and payroll to improve accuracy, enhance employee experience, and reduce administrative workloads.

Employee Onboarding

Simplify and accelerate employee onboarding with automated workflows, ensuring a smooth transition for new hires while reducing manual HR tasks.

Recruiting

Automate the recruiting process, from candidate screening to interview scheduling, allowing HR teams to focus on finding the best talent faster.

Payroll

Ensure timely and accurate payroll processing with automation, reducing manual errors and ensuring compliance with labour laws and regulations.

Information Technology

Automating service desk, ticket handling, and network operations tasks can boost IT department efficiency and allow faster issue resolution and system maintenance.

Service Desk

Automate the service desk with AI-powered tools, enabling quicker responses to IT issues and improving employee satisfaction with faster resolutions.

Ticket Handling

Streamline ticket handling by automating ticket assignments, tracking, and resolution, minimizing downtime and enhancing IT service efficiency.

Network Operations

Automate routine network operations tasks such as monitoring, alerts, and maintenance to ensure uninterrupted service and improved system reliability.

Benefits of Automation in Financial Services

Enhance Compliance

Automation Anywhere consultants implement solutions that ensure consistent monitoring and reporting, improving adherence to regulatory standards and reducing the risk of non-compliance.

Strengthen Controls

With automation anywhere consulting, financial institutions can automate transaction monitoring, quickly detecting and responding to suspicious activities, thus enhancing fraud prevention and overall security.

Increase Productivity

Automation Anywhere consultants help streamline workflows by automating repetitive tasks, allowing teams to focus on higher-value activities and boosting overall productivity.

Connect Systems

Automation Anywhere solutions break down data silos by connecting legacy systems and improving data flow, accelerating processes and increasing efficiency.

Accelerate Teams

With tools like Automation Co-Pilot, teams can seamlessly integrate intelligent automation into their daily operations, driving faster and more efficient workflows with the help of Automation Anywhere consulting.

Reduce Costs

Automation Anywhere consultants help financial institutions automate manual processes, reduce errors, and lower operational costs while minimizing risks and enhancing efficiency.

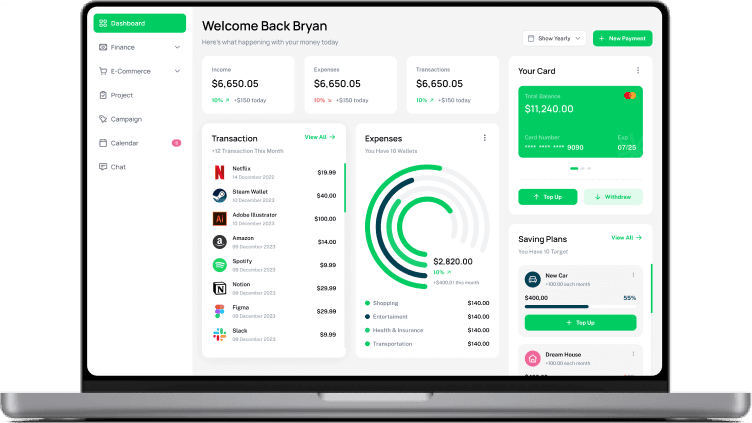

Why Choose – Xponential Digital?

Xponential Digital is your trusted partner for driving digital transformation through tailored automation and AI solutions, including expertise as an Automation Anywhere consultant. Our team works closely with you to streamline operations, improve efficiency, and ensure compliance across various industries, including healthcare, finance, and IT. With deep expertise in automation, we deliver solutions that reduce manual workloads, enhance decision-making, and support long-term growth. Choose Xponential Digital for a reliable, customized approach to modernizing your business.

Get in Touch With Us

Contact us today by filling out the form or sending an email to

Xponential Digital

Xponential Digital